Lending Crowd

Updated

- Low-interest starting from 5.03%

- Peer-to-peer lending up to $200,000

- Repayment up to 5 years

In-page navigation

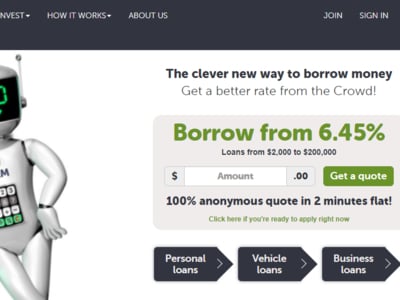

Author Lending Crowd. Screenshot of Lending Crowd website. [Accessed April 29, 2022]

About Lending Crowd

Lending Crowd is New Zealand's most technologically advanced peer-to-peer lending platform - offering both borrowers and investors a flawless platform on which to borrow and lend.

Using their platform is simple, quick, and overall, a flawless process that ensures that transactions go down as they should.

How they work

Investors who want to see a good return on their money invest their savings into the platform which then attracts borrowers who are looking to escape the clutches of large banks and high fees. The investors remain anonymous and so do the borrowers who take out personal loans with Lending Crowd.

Lending Crowd has the best human resources

They pride themselves in the consultants that they have hired because they know that their customers and even management wouldn’t be anything without them. These are the very same people that go above and beyond to ensure that customers get the best credit deals Lending Crowd offers.

This is the reason why their agents will guide you when you are looking for a peer-to-peer loan so that you can choose an advance plan that is affordable for your budget.

What Lending Crowd can offer you

The Lending Crowd offers personal cash loans, business loans, and car loans that range from $2,000 to $200,000.

Their loan range is larger than that offered by their competitors and their rates are competitive. Lending Crowd’s current rate starts from as low as 6.45% and they accept property and vehicles as security.

Secured loans

Lending Crowd takes a platform fee for any loans that are successful and this is added to your final P2P loan cost. If you intend to purchase a vehicle you can use this very vehicle to secure the loan, however, it's important to note that they only offer secured loans.

Apply for a Peer-to-peer loan and save

As one of the most advanced lenders in the country, they offer one of the most streamlined online loan application processes and some of the best rates.

A few additional benefits

If you get your personal or business loan from the Lending Crowd you will get low rates, a loan term of either 3 or 5 years and you can repay your loan early by making additional payments. You can also top up your loan if you need additional funds before the end of the loan term.

Lending Crowd Product Details

- Loan Type Peer-to-peer lending

- Interest Rate 5.03 – 20.3% p/a

- Loan Amount up to $200,000

- Repayment 1 year to 5 years

Apply for a peer-to-peer loan and save

You can get a loan quote by selecting your loan type and entering the loan amount you need on their website. Click on get a quote to receive a quote in 2 minutes. If you are happy, you can then go ahead and apply.

A fully online loan application

One of the biggest advantages that peer-to-peer lending offers you is that you can apply 100% online and save a lot of time and money in the process. They have a quick and easy 8-minute loan application which is amongst the most refined you'll ever come across in the NZ lending market.

- Tell them what you need.

- Fill in your details.

- Wait a few minutes for approval.

- Accept their offer.

- Receive your money.

When l will know of the loan outcome

Time is an important element to the Lending Crowd and they try to ensure that all customers are notified of their loan applications on the same day. The only time they might take longer than usual is when they are awaiting personal documents from you. So, the faster you provide them with the requested documents the faster you will have access to the funds.

Benefits of making use of The Lending Crowd

- Enjoy the lowest interest rates in NZ.

- Full transparency with no hidden fees.

- Simple and speedy online loans.

- The opportunity of doing an anonymous quote without entering any of your details.

- Loan amounts of up to $200,000.

- A marketplace for borrowers and lenders with vast options.

- Your information is kept secure and safe.

- They offer not only borrowing options but also investment options.

- Secured low-cost loans.

- A team of well-organised, friendly, and professional experts.

- Repayment terms of up to 5 years.

- A full loan application in less than 8 minutes.

Lending Crowd is a trusted & reliable provider of peer-to-peer lending

In our review, Lending Crowd adheres to the compliance criteria in accordance with Credit Contracts and Consumer Finance Act (CCCFA), where the granting the loan will not cause financial distress to the consumer.

Lending Crowd is a registered credit provider in New Zealand: FSP390986

Customer Reviews & Testimonials

Lending Crowd Contact Details

Physical Address

- Level 2, 88 Broadway Newmarket Auckland 1023 New Zealand

- Get Directions

Postal Address

- PO Box 17422, Greenlane, Auckland, 1546, New Zealand

Opening Hours

- not available